The dramatic proliferation of CFP (CrowdFunding Platform) is due not just to technological developments but also, in part, to the aftermath of the recession. Banks, VCs and other institutions are still loath to lend to pre-revenue businesses. Angel investors are inundated and reject 99% of the applications they receive and demand a big slice of equity from the 1% in which they are interested. “Friends and Family” are wary and have little if any spare cash. The continued financial depression and lack of growth plans on both sides of the Atlantic are making the difficulties of funding more acute. However, life is also tough for high-street investors as banks continue to offer unattractive rates of interest to savers. At the same time, the development of the internet and social networks has reduced degrees of separation from six to fewer than two, and considerably increased potential marketing reach for new businesses. Crowdfunding may offer a potential escape from both of these key issues.

There is much ignorance in the marketplace regarding both CFP and entrepreneurs setting up CFPs, and those intending to enter the market should seek guidance from professionals who deal with these issues on a daily basis.

To date there are three fundamental crowdfunding business models which prevail, namely Reward, Equity and Loan. The terms “Alternative finance”, “Peer to Peer Lending” and “crowd investing” are often used to refer to the Equity and Loan models, indicating that the investor expects or, at least, hopes to receive a financial return on its money.

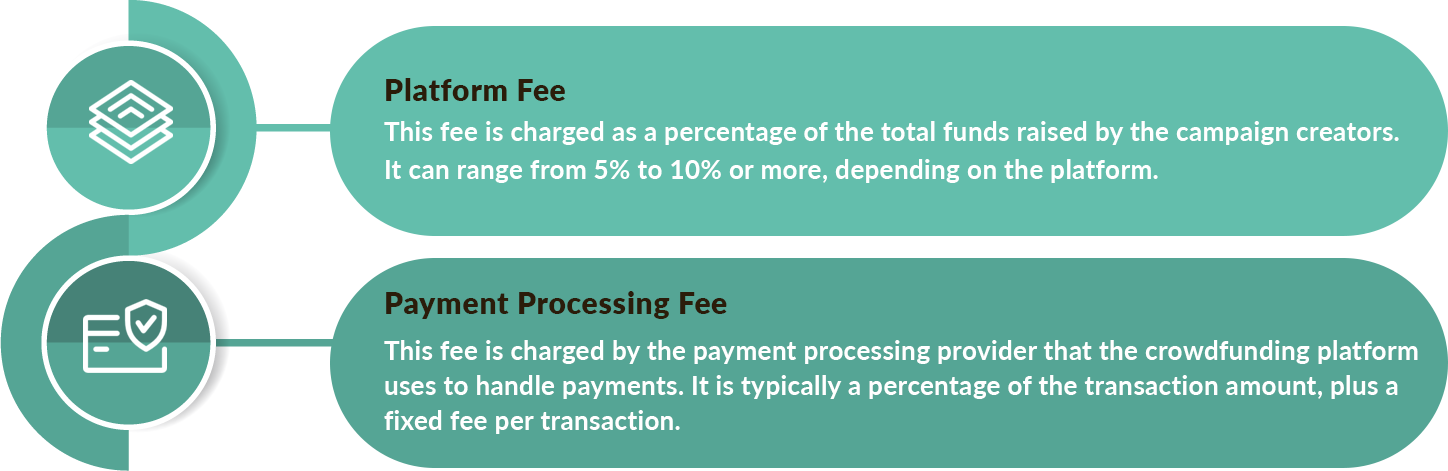

The business model of crowdfunding platforms typically involves charging a fee or commission on the funds raised by the campaign creators.

In addition to these fees, some crowdfunding platforms may also offer premium services to campaign creators for an additional fee. These services may include marketing and promotion, campaign management tools, and access to a network of investors or backers.

Overall, the crowdfunding platform business model relies on providing a convenient and accessible platform for campaign creators to raise funds, while also generating revenue through fees and additional services.

Crowdfunding platforms in India are required to obtain a license from the Securities and Exchange Board of India (SEBI) to operate as an "investment crowdfunding platform" under the SEBI (Alternative Investment Funds) Regulations, 2012.

The platform must be registered as a company under the Companies Act, 2013 or under any other relevant law.

To obtain a crowdfunding license, the platform must have a minimum net worth of Rs. 2 crores.

The crowdfunding platform must have a board of directors with at least two-thirds of the members being independent directors.

The platform must have a sound technological infrastructure and adequate risk management systems.

To obtain a crowdfunding platform license, the platform must comply with Know Your Customer (KYC) norms, Anti-Money Laundering (AML) guidelines, and other applicable regulations.

Once the crowdfunding platform license is obtained, it can facilitate investments in alternative investment funds (AIFs) through its platform. However, the platform cannot raise funds from the public directly and must act as an intermediary between the investors and the AIFs.

It is important to note that there are different types of crowdfunding platforms in India, including donation-based, reward-based, and peer-to-peer lending, which may have different regulatory requirements. It is recommended to consult with a legal expert to ensure compliance with applicable laws and regulations.

Since crowdfunding is still a relatively new phenomenon, there is not always consistency in how different terms are used and defined within the research. However, crowdfunding can generally be divided into four main categories:

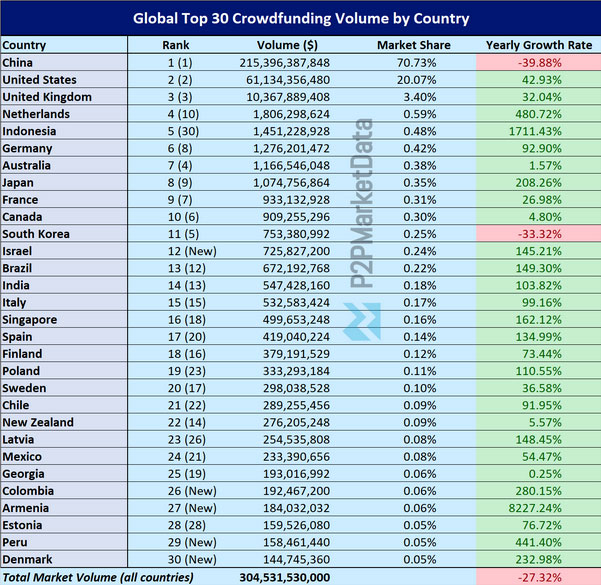

Where last year’s worldwide crowdfunding statistics showed a market in rapid growth in all regions of the world, a recently published report displays a more varied situation. The three countries dominating the world’s crowdfunding market are still China, the United States, and the United Kingdom, but where the US and the UK still show impressive growth rates of 42.4% and 30.7%, respectively, the Chinese funding volume has dropped by -39.9%. However, China is still the market leader worldwide with a market share of 70.7%, followed by the US with 20.0%, and the UK with 3.4%. Next on the list, we find countries like the Netherlands, Indonesia, Germany, Australia, Japan, France, and Canada – all with significantly smaller market share.

Determine the type of crowdfunding platform you want to create. Will it be reward-based, equity-based, donation-based, or a combination? Clarify your revenue model and fee structure.

Understand the legal and regulatory requirements to start a crowdfunding business in your jurisdiction, such as licenses, compliance obligations, and consumer protection laws. Consult with legal experts to ensure compliance.

Outline your vision, goals, target market, marketing strategy, and financial projections. Identify your unique selling proposition and competitive advantage in the crowdfunding market.

To start a crowdfunding business, assemble a team with the necessary skills and expertise, such as technology, marketing, finance, and operations. Each team member should align with your business goals and contribute to the platform's success.

Develop or partner with a reliable technology provider to build a robust and user-friendly crowdfunding platform. While starting a crowdfunding platform, ensure the platform supports essential features like campaign creation, payment processing, and investor communication.

To start a crowdfunding platform, you need to collaborate with payment gateways, legal advisors, and financial institutions to ensure smooth and secure transactions. Form alliances with influential industry stakeholders to enhance your platform's credibility.

Draft comprehensive terms and conditions, privacy policies, and user guidelines. Address important aspects such as intellectual property rights, refunds, and dispute resolution mechanisms.

Develop a compelling brand identity, website, and marketing strategy to attract campaign creators and investors. Utilize digital marketing techniques, social media, content marketing, and partnerships to raise awareness and drive user engagement.

Set up efficient customer support channels to address user queries and concerns promptly. Actively collect feedback and iterate on your platform to enhance user experience and meet their evolving needs.

Continuously monitor your platform's performance, user metrics, and financial health. Identify areas for improvement and leverage user feedback to enhance the platform's functionality and usability.

Remember, starting a crowdfunding company requires careful planning, meticulous execution, and continuous adaptation to market dynamics. It's crucial to stay informed about industry trends, regulatory changes, and user preferences to remain competitive in the evolving crowdfunding landscape.

To start a crowdfunding platform in India, there are several important legal considerations that you should take into account. Here are some key considerations:

Understand and comply with the legal and regulatory requirements applicable to crowdfunding platforms in your jurisdiction. These regulations may include securities laws, consumer protection laws, data privacy regulations, and anti-money laundering (AML) regulations.

Determine if there are any specific licenses or registrations required for operating or starting a crowdfunding company in your jurisdiction. Some countries may require platforms to obtain licenses from regulatory authorities before conducting crowdfunding activities.

Implement measures to protect the interests of investors using your platform. This may include conducting due diligence on campaign creators, implementing investor accreditation or verification processes, and providing clear and accurate information about investment risks.

Ensure that campaign creators provide accurate and complete information about their projects to potential investors. Establish disclosure guidelines and mechanisms to prevent fraudulent or misleading campaigns on your platform.

When starting a crowdfunding company, one must address intellectual property rights concerns on your platform. Establish policies to protect the intellectual property of campaign creators and prevent copyright infringement or misuse of intellectual property by third parties.

Take lawyer’s advice while starting a crowdfunding platform to develop comprehensive terms and conditions that govern the relationship between your crowdfunding platform, campaign creators, and investors. These terms should cover important aspects such as liability, dispute resolution, refunds, and termination of campaigns.

Comply with data protection and privacy regulations to safeguard personal information collected from users of your crowdfunding platform. Implement appropriate data security measures and obtain consent for the collection, use, and storage of personal data.

Establish AML and KYC policies to prevent money laundering and ensure the identification and verification of users before starting a crowdfunding company. Comply with applicable regulations related to customer due diligence, record-keeping, and reporting of suspicious transactions.

Establish clear contractual agreements between your platform and campaign creators/investors. These agreements should outline the rights and obligations of each party, including payment terms, dispute resolution mechanisms, and intellectual property ownership.

Stay updated on any changes in relevant laws and regulations, and adapt your platform and practices accordingly. Regularly review and enhance your compliance processes to mitigate legal risks and ensure ongoing adherence to regulatory requirements.

It is highly recommended to consult with legal professionals experienced in guiding entrepreneurs to start a crowdfunding business and the specific regulations of your jurisdiction to ensure comprehensive compliance with all legal considerations.

Complete the form below and we will contact you to discuss your project. Your information will be kept confidential.