Non-banking financial companies, or NBFCs, are financial institutions that provide banking services, but do not hold a banking license. These institutions are not allowed to take deposits from the public. Nonetheless, all operations of these institutions are still covered under banking regulations NBFCs offer most sorts of banking services, such as loans and credit facilities, private education funding, retirement planning, trading in money markets, underwriting stocks and shares, TFCs(Term Finance Certificate) and other obligations. These institutions also provide wealth management such as managing portfolios of stocks and shares, discounting services

e.g. discounting of instruments and advice on merger and acquisition activities. The number of non-banking financial companies has expanded greatly in the last several years as venture capital companies, retail and industrial companies have entered the lending business. Non-bank institutions also frequently support investments in property and prepare feasibility, market or industry studies for companies.

However they are typically not allowed to take deposits from the general public and have to find other means of funding their operations such as issuing debt instruments.

NBFC Refers to Non-Banking Financial companies. if you are willing to start Lending business you can buy apply for fresh NBFC Registration.

An NBFC-MFI is defined as a non-deposit taking NBFC (other than a company licensed under Section 25 of the Indian Companies Act, 1956).

India is a huge country with a large population. Banks, despite having increased their presence have certain limitations...

MFI Comes Under Priority section. MFI is basically future of financial inclusion. Thus RBI gives mine importance to MFI.

As an incorporated entity by incorporating a company under the Companies Act, 1956 through Joint Ventures; or .

Non Banking Financial Company is an entity governs and regulates by RBI Act 1934.

NBFC facilitates banking related services like financial services, investment services, risk pooling and contractual savings.

NBFCs offer most sorts of banking services, such as loans and credit facilities. These institutions also provide wealth management such as managing portfolios of stocks and shares, discounting services e.g. discounting of instruments and advice on merger and acquisition activities. The number of non-banking financial companies has expanded greatly in the last several years as venture capital companies, retail and industrial companies have entered the lending business. Non- bank institutions also frequently support investments in property and prepare feasibility, market or industry studies for companies. However they are typically not allowed to take deposits from the general public and have to find other means of funding their operations such as issuing debt instruments.

Non Banking Financial Company is an entity governs and regulates by RBI Act 1934.

NBFC facilitates banking related services like financial services, investment services, risk pooling and contractual savings.

NBFCs offer most sorts of banking services, such as loans and credit facilities. These institutions also provide wealth management such as managing portfolios of stocks and shares, discounting services e.g. discounting of instruments and advice on merger and acquisition activities. The number of non-banking financial companies has expanded greatly in the last several years as venture capital companies, retail and industrial companies have entered the lending business. Non- bank institutions also frequently support investments in property and prepare feasibility, market or industry studies for companies. However they are typically not allowed to take deposits from the general public and have to find other means of funding their operations such as issuing debt instruments.

NBFCs can introduce the credit guarantee programme announced by the government likely to boost their fund flow in the economy. NBFCs can open branches anywhere in India and mostly it opens branches in the smaller towns, rural and semi-urban areas and cities to aware general public about the government saving policy, loan structure and all. NBFCs form an integral part of the Indian financial ecosystem. By extending the line of secured and unsecured credit, these companies provide an opportunity to Individuals and businessmen to be a part of economy. NBFCs apart from traditional banks, also understands the customers’ profile and their credit needs. This is why NBFCs are often able to carve their niche based on their customer profile. These customers usually reside in rural area where banking and institutional credit financial services have limited ground presence. Usually, banks often rely on banking and credit history while assessing the loan applications of their customers. Therefore, these new to credit customers do not qualify for a bank loan. To serve this segment, NBFCs have to build the entire machinery in a different way. They need to implement unique models to assess the creditworthiness of applicants and lend them with comparatively less paperwork. For example, some NBFCs lend to micro, small, and medium enterprises basis their invoices due for payment. Such loans are much safer compared to other unsecured loans.

Self-declaration about any penalty imposed by Government authority / Charge sheet/ NI 138 proceeding e.t.c

Any person can take NBFC registration by fulfilling following eligibility criteria.

First step to take NBFC is to register its Company under Companies Act 2013.

Company registration is 15-20 days process. After getting registration Certificate from Registrar of Company, we need to file application to the RBI for NBFC license.

Formation of Company: be it a Pvt Ltd. Company or Public Limited Company with NBFC object and with minimum paidup capital of Rs. 2 Cr.

After incorporation, Bank account opening and Initial capital of Rs. 2 Cr. to be inserted. And the FD creation and receipt of FD is to be provided to us

Drafting of all the documents as per RBI norms.

filing of application online and submission of Hard copies at the RBI Office. This is the first visit to RBI office for the company.

Liasioning with RBI office, submission of additional information documents asked by the RBI office. Multiple visits and follow ups over the months.

Presentation and Meeting with RBI officers

Issuance of registration certificate from RBI and T&C applicability.

As NBFC is regulated with RBI act 1934, apart from ROC and Income tax Compliances, it also needs to do half yearly and annual compliances as per RBI norms. NBFC also needs to take some registrations with CERSAI, CKY and membership with Credit Information Companies and with other entities.

A Non-Banking Financial Company (NBFC) is a form of a business entity registered under the Companies Act 1956 of the Companies Act 2013. NBFCs are included in financial lending and other financial activities. They are defined in terms of Section 45-IA of the RBI Act 1934 Such companies need to get a Registration Certificate (COR) from the RBI to start financial business activities. This process is also known as NBFC registration or getting an NBFC license from the RBI. Another way to start this kind of business is to go to the NBFC.

NBFC takeover is the process of obtaining an active RBI registered NBFC and not going from the initial stage to the NBFC registration procedure. Taking the NBFC is a convenient but complex process. This process is suitable for individuals or corporations who want to choose the fastest and most reliable activity of their financial business. The process is complex and goes through multiple stages, requiring a high level of professionalism and hard work. At Corpus Christi, we have 150+ professionals, CA, CS, CMA, and lawyers who are proficient in the RBI registration and NBFC process. We can service your NBFC needs in less than 60 days.

Target Company- An acquisition company is keeping an eye on a "get-it-all" company known as the Target Company

Acquisition Company- A company that can acquire a target company is known as an acquirer company

The target company is acquired by the acquiring company and the shares of the existing partners are transferred to the proposed partner or organization after following the target process. The acquiring company enjoys its pre-RBI registration of the target company with its market position.

Before buying a business, do thorough research and background check A checklist of the aspects to be examined should be made Create business goals and assess whether the target company can achieve them.

Before submitting an acquisition offer to any company, an acquirer needs to review the list of suitable candidates. During the procedure, a firm will identify candidates who will be a good fit for their firm and meet the main objectives of the recipients.

Preliminary approval required: Prior approval of RBI before transfer/acquisition of NBFC.

Preliminary Approval Application: NBFCs have to submit an application to the bank for approval. With the following documents:

Director / Partner Information

The source of the proposed partner funding to acquire a stake in the NBFC

The director declares that the company receiving the deposit is not affiliated with any company

The directors declare that they are not affiliated with any company whose registration certificate has been revoked by the RBI.

The proposed partner/director declares that they have no criminal background and that the offender has committed a crime under section 138 of the Safety Equipment Act.

The bankers of the proposed director/partner report

Applications will be submitted to the regional office of the Non-Banking Supervision Department under which the NBFC's registered office is located.

At least 30 days before the sale or uncontrolled transfer of shares, a public notice must be provided to the management of the partner or company and the company shall be notified to the local or regional newspaper.

After RBI approval, a memorandum of understanding will be signed stating that both companies have agreed to each other and the token amount will be paid to the target company by the acquiring company.

The Company will then convene a meeting to approve the MOU's approval and plans.

The transfer company will be sent for consideration after the approval of the scheme.

The target company will get NOC from the lender and issue the certificate to the target company.

A share transfer agreement will be signed and the acquiring company will pay the remaining amount to the target company.

Upon receipt of the NOC, the transfer of property and liability will take place and no clause of the contract should be breached.

The value will be assessed along with the cash flow method of the discounted price. The company's current net worth will be assessed The CA will briefly get a certificate that has been adopted to determine the value of the organization.

If the acquiring company has a 75% stake in the scheme or contract, they have the right to exempt the minority shareholders.

The next step in this regard is to apply to the regional office of the non-bank supervision department under which the NBFC registered office is located. Generally, an application for NBFC sales goes through three to four months of processing time in the general business. The following required documents must be submitted to the RBI office with a letter from the company:

For every NBFC, starting the operation of its business, it is necessary to have a license from Reserve Bank of India. The procedure for NBFC registration begins with registered private or public limited company. But the objective of your registered company is totally financing.

NBFC registration is important, RBI started regulating the activities of NBFC with the twin objective of ensuring that they sub serve the financial system and do not jeopardize the interest of depositors.

If a person wants to register online pokie machines its company as a non-banking financial company with RBI, one application is to be made to the RBI and along with various documents/instructions are to be submitted in duplicate like: -

Some more documents are also needed along with all these above-mentioned documents, If RBI deems fit that the applicant is satisfying all condition for its fulfilment, then RBI will issue unique NBFC registration number. NBFC registration number is having an excellent value from the legal point of view. NBFC number is also very important for RBI regarding manage and regulate thereon banking financial institutions.

Also, application for NBFC Registration can be obtained from the RBI website along with information regarding the document needed. Generally, NBFC License can be obtained in 100 to 120 days. As compared to a previous year now the NBFC formation procedure is much easier.

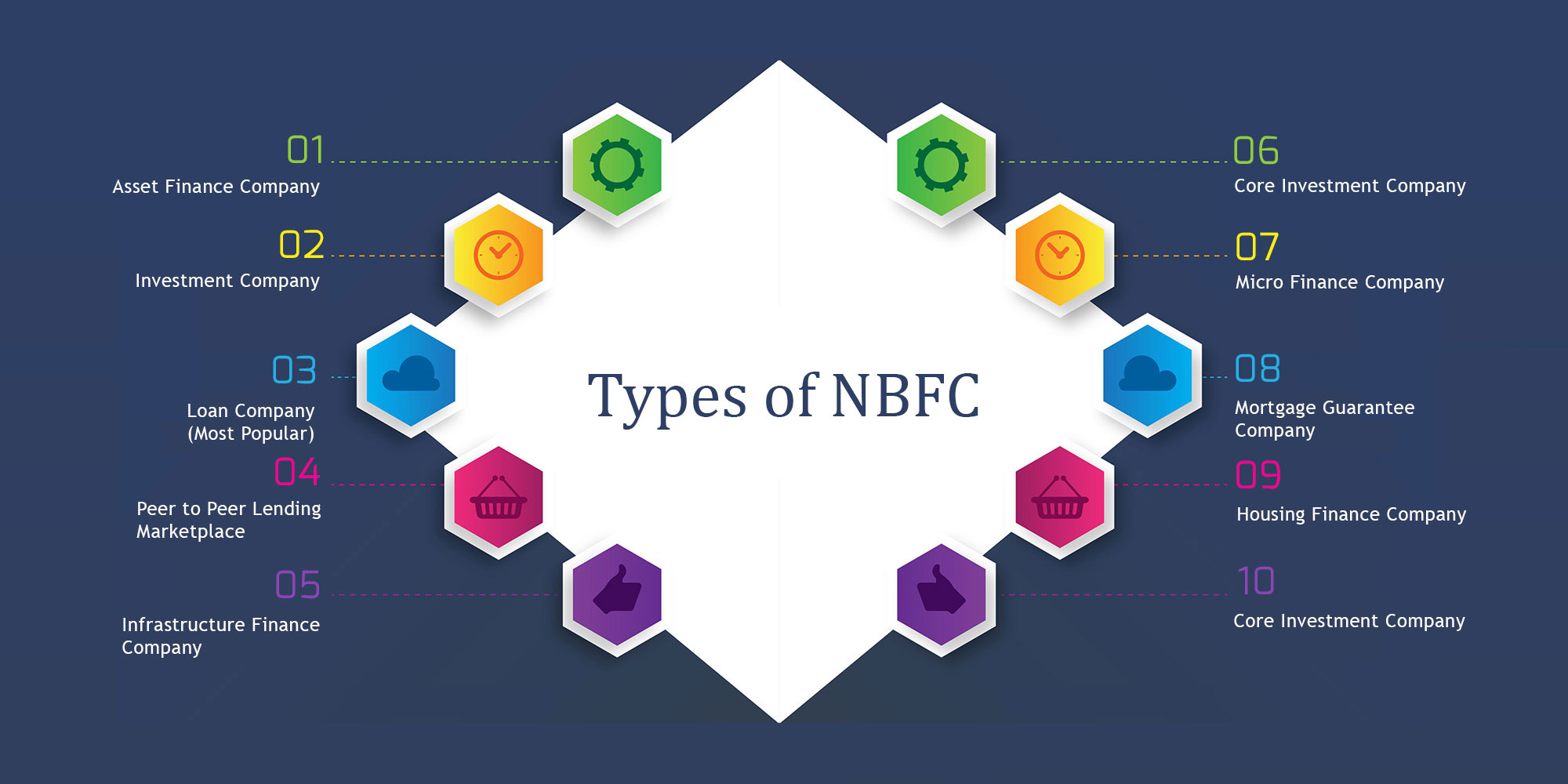

ASSET FINANCE COMPANY (AFC)

INVESTMENT COMPANY (IC)

LOAN COMPANY (LC)

INFRASTRUCTURE FINANCE COMPANY (IFC)

RESIDUARY NON-BANKING COMPANIES (RNBCS)

Services Delivery by CA, CS, Advocate, & management, expert

India's best NBFC consultancy

Peacee Of mind

15+ years of experience

100% NBFC licence assurance

As a NBFC consultant our team of competent professional’shas expertise in providing assistance for setting up of NBFC and offer various related services to our clients, so they don’t have to make any extra efforts for the formation of NBFC. At Finlaw we provide full services in regard to setting up of NBFC and other requirements needed for it.