FIU stands for Financial Intelligence Unit. It is a specialized agency responsible for collecting, analyzing, and disseminating financial intelligence to combat money laundering, terrorist financing, and other financial crimes.

FIUs typically receive reports of suspicious transactions and other financial information from various sources, including financial institutions, designated non-financial businesses and professions (DNFBPs), law enforcement agencies, and other government entities.

FIUs analyze the received information to identify patterns, trends, and anomalies indicative of potential money laundering, terrorist financing, or other illicit activities. This analysis may involve data mining, financial profiling, and other investigative techniques.

FIUs share intelligence and collaborate with domestic and international counterparts, including other FIUs, law enforcement agencies, regulatory bodies, and international organizations, to facilitate the exchange of information and enhance efforts to combat financial crime.

FIUs produce and disseminate reports based on their analysis and findings. These reports may include suspicious transaction reports (STRs), financial intelligence reports (FIRs), and other types of intelligence products to assist law enforcement agencies and other stakeholders in their investigations and preventive measures.

FIUs provide guidance, training, and technical assistance to reporting entities, law enforcement agencies, and other stakeholders to enhance their understanding of money laundering and terrorist financing risks and improve compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations.

FIUs may contribute to the development of AML/CFT policies, regulations, and guidelines at the national and international levels by providing expertise, research, and recommendations based on their analysis and operational experiences.

FIUs monitor the compliance of reporting entities with AML/CFT obligations, including the submission of suspicious transaction reports and other regulatory requirements. They may conduct examinations, assessments, and audits to ensure adherence to relevant laws and regulations.

Secure Your Cryptocurrency Business and Carry Out Your Operations in India Seamlessly with FIU IND Registration

FIU Registration is the procedure by which organizations and people conducting financial transactions in India register with the Financial Intelligence Unit - India (FIU-IND). The FIU-IND is a government organization that monitors and enforces anti-money laundering (AML) and counter-terrorism funding (CTF) rules. The FIU Registration Process can be a tedious task, hence expert guidance is pivotal to ensure a smooth sailing journey.

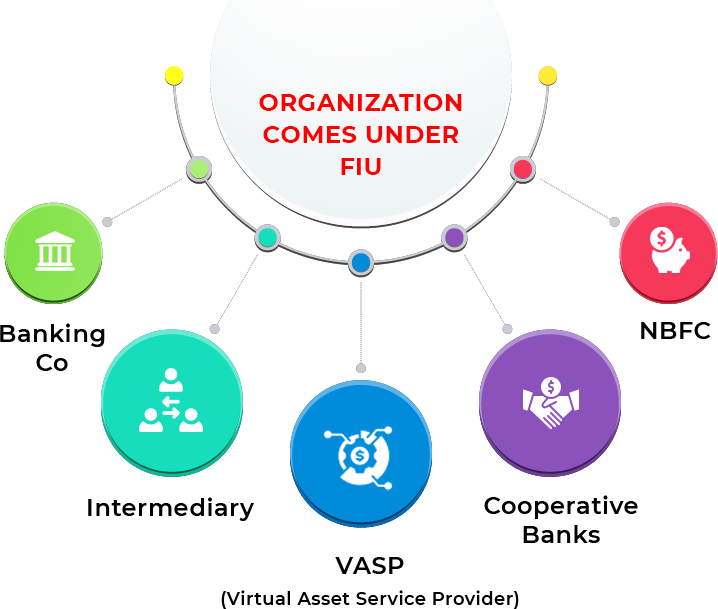

FIU IND Registration is critical for enterprises such as banks, financial institutions, and other entities engaged in financial transactions due to its statutory and regulatory relevance. Businesses in the financial sector are legally required to register with the Financial Intelligence Unit - India (FIU-IND) to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. This registration guarantees that entities follow national regulations aimed at combating financial crimes and preserving the integrity of the financial system.

Determine whether your company has to register with the Financial Intelligence Unit - India (FIU-IND). Banks, financial institutions, real estate brokers, and jewelry dealers must follow anti-money laundering (AML) and counter-terrorism financing (CTF) legislation.

Collect the relevant documents, including:

Complete the registration form available on the FIU-IND website. Provide information about your company, compliance officer, and AML/CTF policies.

Submit the completed form and papers to FIU-IND using their online portal, email, or physical submission, as per their instructions.

FIU-IND will review your application. If more information is required, they will contact you. You will receive a registration certificate once your application has been approved.

Establish internal controls, provide employee training, and begin frequent reporting of suspicious activities and significant transactions as needed.

Regularly update your AML/CTF policies and stay up to current on regulatory developments. Keep your registration active by ensuring that your practices stay compliant.

Monitor registration renewal deadlines and submit any necessary revisions or renewals on time to keep your registration status.

Meeting these criteria ensures that businesses follow legal obligations, preserve operational integrity, and contribute to the larger fight against financial crime.

Arguably the most prevalent issues is submitting incomplete or erroneous documentation. Ensure that any needed documentation, such as documentation of business registration, key staff identification, and compliance program data, are precise and up to date. Double-check all documents to avoid delays or rejection of your application.

Meeting deadlines is vital during the FIU registration process. Skipping submission deadlines can result in charges or delays in receiving your registration. Keep note of all important dates and submit your application and any relevant documentation on time to avoid difficulties.

After you've registered, you must keep your information up to date. Failure to update changes such as key persons, business addresses, or compliance practices can lead to noncompliance. Regularly examine and update your registration information with FIU-IND to reflect any significant changes and ensure compliance with regulatory obligations.

Avoiding these typical blunders can assist to ensure a seamless and successful FIU registration process, as well as your company's compliance with anti-money laundering and counter-terrorism funding requirements.

Getting the FIU registration process right is critical for guaranteeing legal compliance with anti-money laundering and counter-terrorism funding rules. Accurate registration protects enterprises from penalties, ensures operational legality, and contributes to national security. Businesses that follow these legal duties protect their operations, increase their confidence, and contribute to the financial system's integrity. Compliance is more than just a legal necessity; it represents a commitment to ethical and responsible business operations.

It is important to note that if a VASP does not register with FIU-IND as a reporting organization, this would constitute non-compliance with the requirements of the PMLA and could result in action under Section 13(2) of the PMLA. Actions may involve:

Furthermore, the FIU-IND may direct the Ministry of Electronics and Information Technology (MeitY) to restrict non-compliant reporting entities' URLs and mobile applications. It was reported in January 2024 that show-cause notices were given to nine offshore VASPs for apparent noncompliance with the terms of the PMLA, PML Rules, and FIU-IND directives.

Foreign businesses can register with FIU once they have an entity registered as a company in India.

Approximately 30 days.

Complete the form below and we will contact you to discuss your project. Your information will be kept confidential.