Bank Without Branch

Bank Without Branch Future Of Banking

Future Of Banking

There is a need for new-age banking solutions to cater to the millennials changing requirements by leveraging state-of-the-art technology.

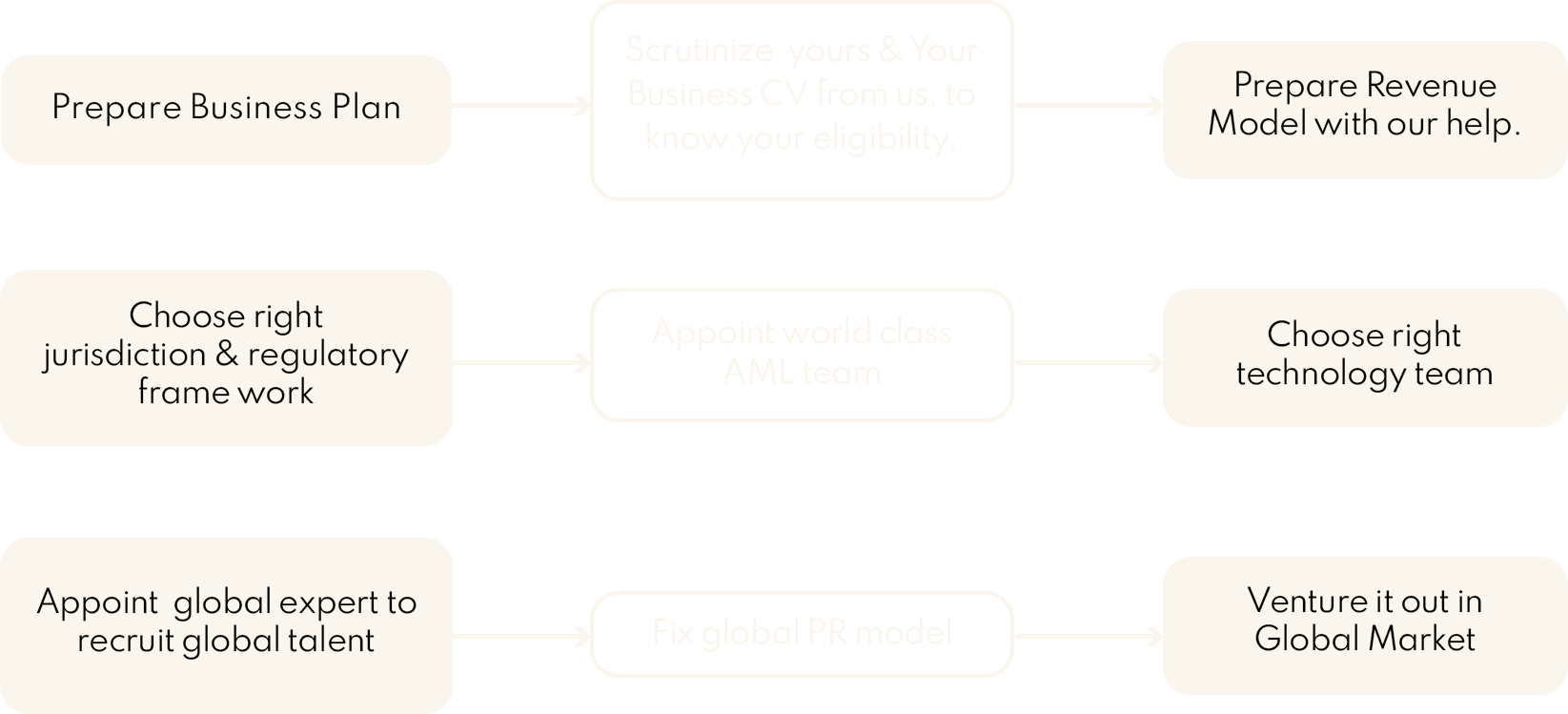

We will help you in connecting the right resources globally and your vision & business ethics will help you to reach the people across the globe.

NEO banking will disrupt the existing banking structure for sure but the whole world moving towards digitalization, so is banking. Now the world is a global village & current banking infra is absolutely not enough to accommodate unbanked.

Unbanking is a major issue, which encourages Ponzi operators to loot the common man. Neo banking will help everyone at the end to access banking.

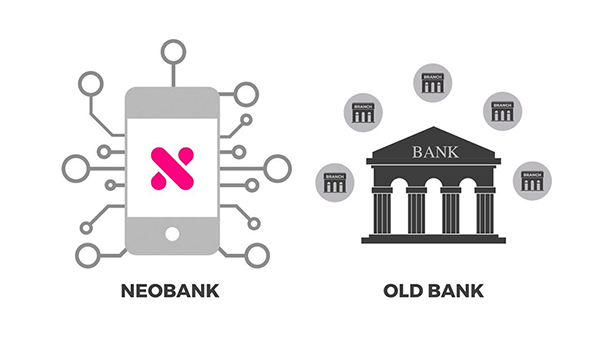

Neo banking solutions simplify every aspect of your banking needs. Thanks to digitalization, banks now offer most of their services online. It is introducing a new trend in the form of Neo bank in the Fintech industry, also known as digital banking. They offer all the benefits of a traditional bank, which is never one step away. By eliminating infrastructure and overhead costs associated with traditional banks, Neo banks provide their customers with lower fees and higher interest rates.

Neo bank is a financial institution that offers customers a cheaper alternative to traditional banks. You can think of a neo bank as a bank without any physical branch, providing services that traditional banks do not, and effectively do. They leverage technology and artificial intelligence to provide personalized service to customers while reducing operating costs.

Neo bank offers comprehensive personal banking solutions through mobile or web apps. The innovative platforms take this whole step forward with the whole banking experience online. This simplifies the process of opening and managing a bank account and gives customers the flexibility to add only the services they want or need.

As Finlaw is one of the pioneers in the fintech industry, our skilled and experienced professionals will help you with the appropriate Neo Banking solutions.

The recent rise in financial technology has also brought a new wave of banking regulations. Many of the world’s financial judiciary are embracing innovation and facilitating the entry of new digital players into the financial system with light regulators as a way to modernize their financial services landscape and increase competition.

As part of this regulatory process, a new type of digital banking or Neo Banking license has been created These are lightweight versions of banking licenses designed to accommodate digital business models, allowing these companies to provide services like banking but within a lower regulatory and compliance framework. For all kinds of assistance, don’t hesitate to reach us at Finlaw.

Neo banks bridge the gap between the services provided by traditional banks and the evolving expectations of customers in the digital age. They are changing the face of Fintech and may one day eclipse traditional banks.

In India, these companies do not have their own bank licenses but rely on bank partners to provide licensed services. This is because the Reserve Bank of India (RBI) does not allow banks to be 100% digital (although some foreign banks only provide digital products through their local units.) The RBI continues to prioritize the physical presence of banks.

Many may be confused with the digital bank. Both are the same because they provide banking services through smartphones and other devices. Neo bank is a financial institution that offers customers a cheaper alternative to traditional banks.

With easy credit and easy access to the economy, NEO banks can be seen as a successful way. With the financial plight of the epidemic, it has also contributed significantly to the successful launch and development of NEO Banks in India. With the proliferation of digitization in India and the use of mobile technology, a paradigm shift by NEO Banks from the oldest physical bank to online banking in the country has changed. Therefore, it can be said that the epidemic has changed the paradigm in the banking and payment industry in India. There are several legal aspects in the Neo bank concept. Finlaw has qualified resources to deal with such issues and provide proper Neo Bank Legal Consulting to its clients.

NEO bank is a bank that only runs banks online. With its new operating system, it has no traditional branch physical network. Thus, it can be accurately described as a new entrant in the digital payment space.

Following the recommendation of the Digital Banking Licensing Commission, Nobank plans to seek clarification on its recommendations, and the government is urging the think tank to include a system for retail banking.

The Policy Commission has recommended the recommendation of a working group under the Reserve Bank of India (RBI) to regulate digital banking.

The Commission's recommendations cover the new wave of Neo bank Fintech, which works with partner banks and serves as a technology level for those banks for customer acquisition and banking activities.

The Commission has recommended a three-step process for obtaining a full-stack Neo banking license and said that the medium, small and micro enterprises (MSMEs) will be given end-to-end financing, deposits, and other banking services.

The Neo Banks have not yet been approved by the Reserve Bank of India (RBI). Therefore, in order to provide financial products and services, they have to be involved with regulated banks and financial institutions.

Neo banks are a financial technology company that provides banking-like services through the digital interface. While these services are similar to the services offered by traditional banks and paid lenders, these are not subject to the same regulatory framework that governs more traditional institutions. Finlaw can help its client with Neo Banking Regulatory Support.

Before being able to provide financial services, one usually needs some form of financial license. Licenses vary between permitted activities and requirements within the organization and are usually issued by local regulators such as central banks and financial market supervisors and government agencies.

Regulatory framework and licensing requirements vary between authority and financial services types. The choice price of the regulatory license depends on the proposal and the business model that was created earlier.

With the advent of technology, many bank transactions can now be conveniently clicked on at home without the need to visit any bank branch. Many Fintech companies such as Neo Bank have also emerged to provide a seamless customer experience in banking transactions. Neo banks partner with regulated banks and provide financial services without any physical affiliation. But the absence of a direct regulatory license for these platforms was considered a key factor in the growth of the industry. There are many legal experts in Fin law, you can get their inputs to make your things easier.

Financial services are regulated in a variety of ways For example, the range of activities of banks is limited; Funding is needed to reduce the risk Interest rates to protect consumers; Reporting Required for Monitoring and Transparency All of these rules are designed to keep the economy stable, protect customers, and achieve social results.

For Neo Banking Setup, licenses can be divided into (full, traditional) banking licenses and (partial, lightweight, modern) Fintech licenses. A banking license allows a financial institution to accept customer deposits and issue loans using that customer's funds. It allows for a wide range of services, but it is also highly regulated (note that only companies with banking licenses can call themselves a 'bank').

A competent regulatory authority, usually a banking license, is issued by the central bank The relevant authorities will depend on the geographical location of the content and the geographical location of the geographic area where you work.

These could include supranational regulators such as the European Central Bank (ECB) or the Federal Reserve (Fed) of the United States and the local currency regulators such as the Saudi Arabian Monetary Authority (SAMA) or the Hong Kong Currency. Authority (HKMA)

A banking license application for a new digital bank can be a complex and costly option. The advantage is that it allows the provision of comprehensive banking services, but it is highly regulated and compliance is mandatory and often comes with higher capital requirements.

The application process for a banking license is also very long and can take up to 15 months depending on its rights.

Complete the form below and we will contact you to discuss your project. Your information will be kept confidential.