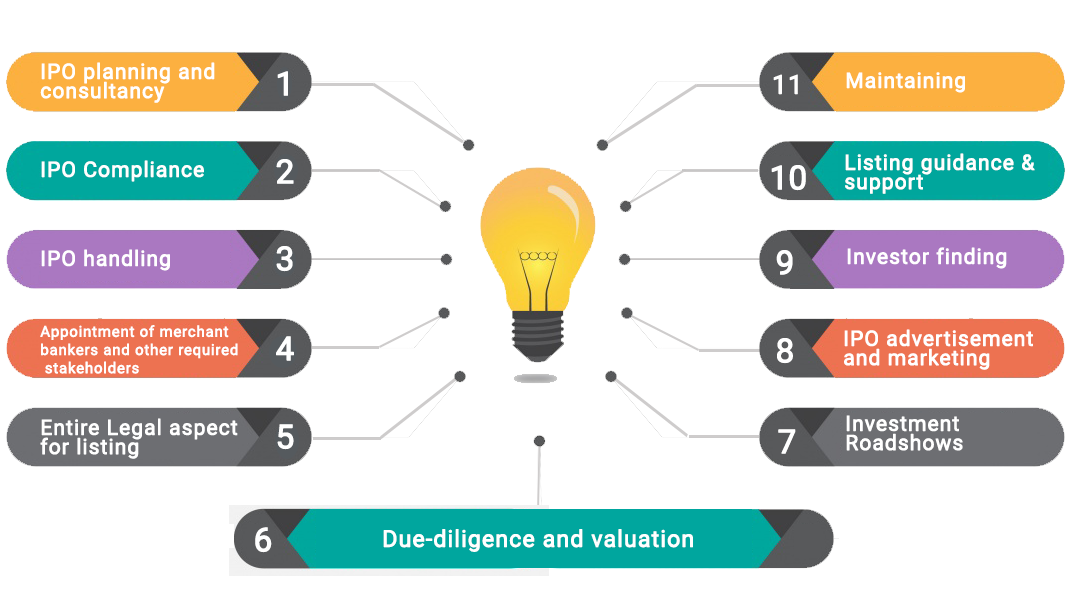

"We do everything from planning till your company get listed"

SME segment has been in our prime focus. The deep understanding of our experienced team about the segment built over the years of work and exposure has provided us with unmatched excellence. We have built upon a team of professionals especially catering to this segment. We provide an overall understanding of the SME listing including regulatory framework, processes involved, and benefits. We offer one-stop comprehensive access to SME listing and several other related aspects at one place.

Companies / Firms can go for SME IPO who are looking to raise funds by diluting their control to a small extent.

Basic Requirement Would Be

Platform Available in India

We work closely with small and mid-sized businesses, with more than 6 years of successful track record of delivering good revenue growth, meaningful profit margins we also provide end-to-end support in raising growth capital from various financial institutions (Private Equity Funds, Banks and NBFCs).

Our teams are in regular touch with various Private Equity Funds and is updated with their investment preferences. This understanding helps us in selecting and structuring the investment pitch for the SME. We take care of the BSE SME exchange listing requirements, so that you can concentrate on increasing the productivity of your business.