Top Jurisdictions for Obtaining a Cryptocurrency Broker License in 2025

Explore the top jurisdictions for obtaining a cryptocurrency broker license in 2025, offering clarity, tax incentives, and supportive regulatory environments.

As the cryptocurrency market continues to evolve, securing a cryptocurrency broker license in a favorable jurisdiction is crucial for businesses aiming to operate legally and competitively. In 2025, several countries have emerged as leading destinations for obtaining a cryptocurrency broker license, offering clear regulatory frameworks, tax incentives, and supportive environments for crypto enterprises. Below is an in-depth analysis of the top jurisdictions to consider.

What is a Cryptocurrency Broker License?

A cryptocurrency broker license allows businesses to legally facilitate the buying and selling of digital assets on behalf of clients. It ensures compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations while providing credibility and trust to investors. The process of obtaining a cryptocurrency broker license varies by jurisdiction, with each country imposing different regulatory requirements, tax structures, and compliance obligations.

Factors to Consider When Choosing a Jurisdiction

Before selecting a jurisdiction for obtaining a cryptocurrency broker license, businesses must evaluate key factors such as:

-

Regulatory clarity: A well-defined legal framework reduces uncertainties and operational risks.

-

Tax policies: Low or zero capital gains tax on cryptocurrency transactions can benefit brokers.

-

Operational costs: Some jurisdictions have lower compliance fees and operational expenses.

-

Market accessibility: Access to global financial markets can impact business scalability.

-

Compliance requirements: Stringent AML and KYC regulations ensure business legitimacy but may add complexity.

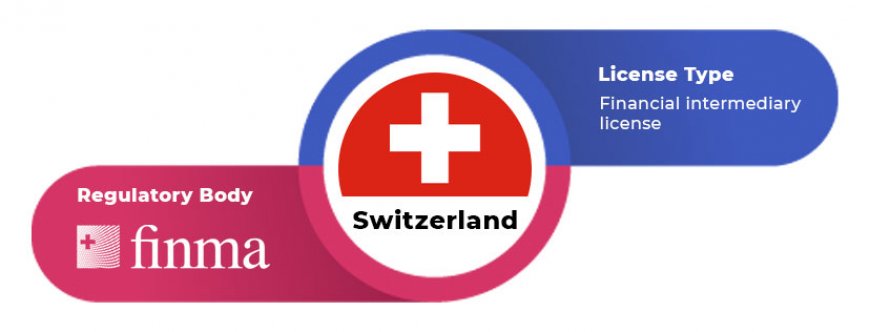

1. Switzerland

Switzerland remains a global leader in the cryptocurrency space, particularly in the city of Zug, known as "Crypto Valley." The Swiss Financial Market Supervisory Authority (FINMA) provides clear guidelines for crypto businesses, ensuring a transparent regulatory environment. The country's favorable tax policies and robust financial infrastructure make it an attractive destination for obtaining a cryptocurrency broker license.

-

Regulatory body: FINMA

-

License type: Financial intermediary license

-

Key benefits: Strong investor protection, banking support, and tax efficiency

-

Drawbacks: High compliance costs

2. Singapore

Singapore is renowned for its progressive stance on cryptocurrencies. The Monetary Authority of Singapore (MAS) regulates digital assets through the Payment Services Act, offering clarity and security for businesses and investors. With low capital gains tax on crypto transactions and a thriving fintech ecosystem, Singapore is a prime location for crypto brokers seeking licensure.

-

Regulatory body: MAS

-

License type: Payment Service Provider License (PSPL)

-

Key benefits: Crypto-friendly laws, strategic location, and global financial hub

-

Drawbacks: Stringent licensing requirements

3. United Arab Emirates (UAE)

The UAE, particularly Dubai and Abu Dhabi, has positioned itself as a global crypto hub. The Dubai Virtual Asset Regulatory Authority (VARA) provides a well-defined framework for digital assets, and the country has launched several crypto-friendly free zones, such as the Dubai Multi Commodities Centre (DMCC). With zero personal income tax and business-friendly regulations, the UAE is a top choice for crypto entrepreneurs.

-

Regulatory body: VARA

-

License type: Virtual Asset Service Provider (VASP) License

-

Key benefits: No income tax, pro-business environment, strong financial sector

-

Drawbacks: Evolving regulations

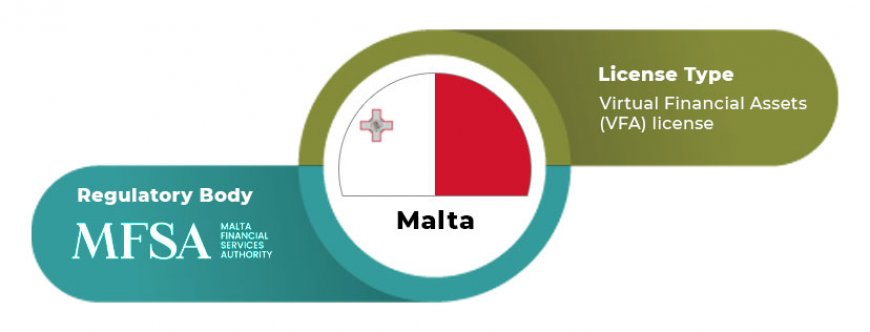

4. Malta

Malta has garnered attention as a favorable crypto jurisdiction, pioneering bespoke cryptocurrency regulations that provide significant legal clarity. The Virtual Financial Assets Act (VFAA) offers comprehensive guidelines for crypto businesses, attracting major industry players to the island nation. While license fees can be substantial, Malta's attractive tax environment and proactive regulatory approach make it a compelling choice.

-

Regulatory body: Malta Financial Services Authority (MFSA)

-

License type: Virtual Financial Assets (VFA) License

-

Key benefits: Defined regulatory framework, investor protection, tax incentives

-

Drawbacks: High initial setup costs

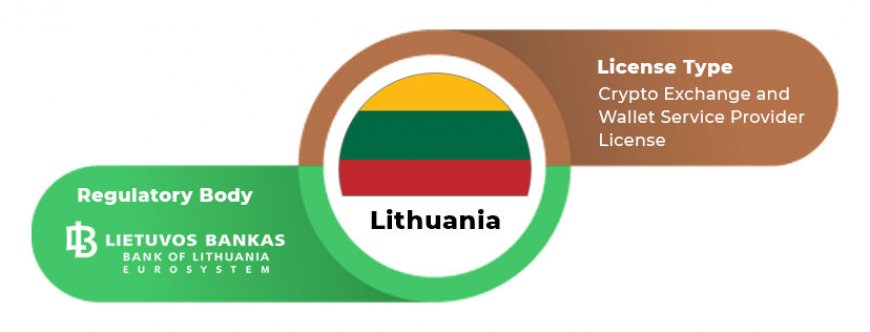

5. Lithuania

Lithuania has rapidly developed into a blockchain hub, offering a secure and innovation-friendly environment. The country provides cost-efficient operational expenses and a streamlined licensing timeline, making it appealing for crypto startups. With a flat corporate income tax rate and various incentives, Lithuania is emerging as a competitive jurisdiction for crypto broker licenses.

-

Regulatory body: Bank of Lithuania

-

License type: Crypto exchange and Wallet Service Provider License

-

Key benefits: Low setup costs, EU market access, fast licensing process

-

Drawbacks: Limited banking support

6. Estonia

Estonia has cultivated a reputation as a jurisdiction amenable to cryptocurrency innovation, with proactive government adoption of digital services. The country's e-residency program and supportive initiatives have attracted numerous crypto businesses. However, recent regulatory tightening mandates local residency for board directors and stricter compliance standards, which prospective licensees must consider.

-

Regulatory body: Estonian Financial Intelligence Unit (FIU)

-

License type: Virtual Currency Service Provider License

-

Key benefits: Innovative digital infrastructure, quick registration

-

Drawbacks: Recent regulatory tightening

Considerations for Indian Entrepreneurs

For Indian entrepreneurs looking to obtain a cryptocurrency broker license, understanding the domestic and international regulatory landscapes is essential. India has shown a dynamic stance on cryptocurrencies, with recent developments indicating a more accommodating approach. However, comprehensive regulations are still evolving, and challenges such as high taxation on crypto gains persist.

Thus, Indian entrepreneurs may consider jurisdictions with more established regulatory frameworks, such as Switzerland, Singapore, and the UAE, to ensure compliance and operational efficiency. Engaging with legal experts familiar with international crypto regulations can provide valuable guidance in selecting the most suitable jurisdiction for obtaining a cryptocurrency broker license.

Conclusion

Selecting the appropriate jurisdiction for obtaining a cryptocurrency broker license in 2025 requires careful consideration of regulatory clarity, tax policies, and the overall business environment. The jurisdictions highlighted above offer favorable conditions for crypto enterprises, each with its unique advantages. Conducting thorough due diligence and consulting with legal professionals will be crucial in navigating the complexities of international crypto regulations and establishing a successful brokerage operation.

For a deeper dive into cryptocurrency-friendly countries in 2025, check out Top 10 Cryptocurrency-Friendly Countries in 2025.

What's Your Reaction?